The World Bank announces a one billion dollar support for social protection in India. This is in addition to the one billion dollar support for Indian healthcare. And there will be a third program coming up for economic stabilization of India. Where does this money come from? They are just printing and printing with no backup money. Papers and papers that will bankrupt America and Europe. I warned in my article:

Horrible: Agenda 2030 Goal 1; Wage-Slavery, Social Settlement, Building the 3rd World By Keeping The West In Hunger

The World Bank is rushing to bankrupt the west and mobilize the money to the least developed countries. With crushing the west’s economy, hiding behind the wings of an invisible virus, the international looters are beating the dead horse and urging to shift the economic poles of the world. It piggybacks the West to distribute its wealth to the least developed countries on their list.

On “republic world” a major Indian newspaper we read:

World Bank Announces $1 Billion Social Protection Package For India To Fight COVID-19

“In a big move, the World Bank on Friday announced a $1 billion social protection package for India to aid the country’s efforts to fight the dreaded Coronavirus.”

“In a big move, the World Bank on Friday announced a $1 billion social protection package for India to aid the country’s efforts to fight the dreaded Coronavirus pandemic. This $1 billion social protection package would be linked to the Government’s programs and schemes launched to aid the vulnerable section of the population, hard-hit amid the pandemic.”

In a report titled” MOBILIZATION OF PRIVATE FINANCE” by 7 BY MULTILATERAL DEVELOPMENT BANKS AND DEVELOPMENT FINANCE INSTITUTIONS 2017, on the “International Finance Corporation of World’s Bank Group” aka IFC; a sister organization of the World Bank, page 8 we read:

(This article is part of a bigger article published on April 8th, 2020, Read here.)

Loading...

Loading...

“In 2015, the global community adopted the 2030 Sustainable Development Agenda and the Sustainable Development Goals (SDGs) that underpin it, and made commitments at the 21st Conference of the Parties to the UN Framework Convention on Climate Change. In July of the same year, the Third International Conference on Financing for Development recognized that the financial resources needed to achieve the SDGs far exceeded current financial flows. Indeed, as explained in a paper prepared for the Conference and endorsed by the World Bank/IMF Development Committee in April 2015,1 the world needs to move from billions to trillions of dollars of financing to meet the challenge of promoting inclusive, sustainable growth, reducing poverty and inequality, and protecting the planet. A wide range of stakeholders see a critical role for Multilateral Development Banks (MDBs) and other Development Finance Institutions (DFIs) in blending public and private finance to scale up financing for development. In adopting the Hamburg Principles last year, the G20 welcomed the role of the MDBs in mobilizing and catalyzing private capital and endorsed a target of increasing mobilization by 25 to 35 percent by 2020. In response, MDBs and bilateral DFIs have taken steps to catalyze more private investment, taking into account quality standards and the risk profile of different markets, as mobilization is generally more difficult in higher risk markets. This includes tapping into larger sources of capital such as pension funds, sovereign wealth funds, and insurance companies. Many do this by leveraging their own capital base by borrowing from capital markets to increase their own ability to finance development. In addition, they catalyze greater private investment through a range of other functions, including: i) helping evaluate and structure high-quality investment projects; ii) helping mitigate real and perceived risk associated with investments that have a positive development impact; iii) mobilizing resources from and co-investing alongside both traditional investors and new sources of commercial financing for develop.”

Did you hear folks?? They have designed, tailored, and wore it all by themselves but pretend that we had some role in the agenda and therefore, we have to comply. To move from billions to trillions of dollars of financing to meet the challenge of promoting inclusive what?? Inclusive financing? Now from racism and inclusivity from what we do, where we work and what we say to forcefully finance other countries to be inclusive? To borrow from international funds to be able to transfer the capital?? Are they insane?

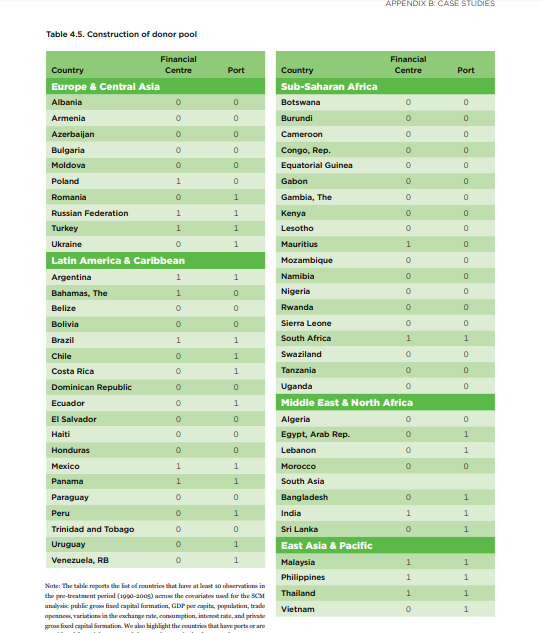

The countries listed are The Philippines Estimated Private Catalyzation Amount: $6.3 billion, Ghana $374 million, Turkey $8.3 billion, Tanzania $108 million, and Panama $47 billion, and then we reach to the final chart of countries to be funneled with the western money flow which is this chart at page 67.

While we are doing our normal lives and just don’t listen to all these warnings, their international looters are serving the main agenda and systematically funneling our money to these countries for no reason other than the socialization of the west and keeping us hungry.

Author's note at the end of each post: -"Your biggest problem is so small for such a big God"-Ella Cruz" The Bible serves as the blueprint of faith, and the New Testament provides us with God's faith and the power to perform miracles through faith and the name of Jesus. Regardless of the severity of cancer, healing can be achieved through faith in God's word. When Jesus raised the dead, he did not discriminate based on the level of death. He simply called forth life. Let's explore how he did it. The first time Jesus brought someone back from the dead was the daughter of Jairus, an official in Jerusalem. Although she had passed away, she was only recently deceased. The second time was the son of a widow in Nain who had been dead for just one day. Lastly, Jesus raised Lazarus, the brother of Mary and Martha in Bethany, who had been dead for three days. He raised them all. No matter how insurmountable your problem may seem, Jesus is the resurrection and the light. Ella Cruz World's events are happening so fast. Global Governance 2015, Agenda 2030, Agenda 2050, Antarctica, Mars, CERN, G5, The United Nations, The European Union, the Club of Rome, and the false prophets of the Vatican all together, we see that the satanic global government is imminent, and it shall come to pass. The mark of the beast will be obligatory. You are either a Christian or not. If you are, you believe this because it is predicted 2000 years ago in the Bible. But if you are not a Christian, you read the news and notice that the satanic world government is their agenda. Their Global Governance 2025 is terribly close. Their Green New Deal 12-year timeline matches the agenda 2030. We have a short time to prepare ourselves. Born-again Christians are happy and calm. Why? Why do we joyfully dedicate ourselves to the nation, knowing that we will be chased and prosecuted? Because we are dedicated to the Kingdom. "Thy kingdom come; Thy will be done." 1. We firmly believe that Jesus Christ is the Son of the Living God. 2. We hold the Bible as the divinely inspired Word of God. 3. We believe that God loved us so much that He sent His only begotten Son to die on the cross for our sins. Through His precious blood, all our sins are washed away and forgiven. 4. We believe that the price for our salvation, health, prosperity, happiness, and eternal life has been paid by the blood of Jesus. These gifts are freely available to us through the grace of God. By His stripes, we were healed 2000 years ago. 5. We acknowledge that by accepting Jesus Christ as our Lord and Savior, we open our hearts to the Holy Spirit. We are baptized by the Holy Spirit, who dwells within us and communicates with us through dreams, visions, speeches, videos, books, and other means. This communication begins immediately after our salvation. 6. We firmly believe that Jesus Christ remains the same yesterday, today, and forever. As born-again believers, we receive the same DNA as Jesus Christ, with the same miraculous abilities through faith. Just as the apostles performed signs and wonders like Jesus, we too can accomplish these miracles through faith, and the Lord will work through us. 7. We condemn the Vatican's religion and many false prophets who have deceived Christians for centuries, hiding the true message of the Bible and the Good News from people to maintain their power. We welcome all denominations and strive for unity in the body of Christ. 8. We believe that a born-again Christian never truly dies. When a believer's life on earth ends, they are promoted to heaven, and death holds no power over them. In heaven, we experience immense joy, love, peace, and the glory of God. Those who have had near-death experiences or have seen Jesus in a vision or dream know the indescribable relief and joy of being in His presence. To answer the question of why we are happy, we say that we could happily die at any moment. In fact, we long to go home and be with our Lord. However, we know that each one of us has a mission and purpose revealed to us by the Holy Spirit after our born-again experience. For the sake of fulfilling that mission, we remain joyful and relaxed in the spirit, knowing that we are called to save people by preaching the Gospel and bringing them to Jesus. To be born again, you just need to say: Lord Jesus, I accept you as my personal savior, Come to my heart, Forgive my sins, Wash me away, Make me a new person, And live inside of me. In the Name of Jesus from Nazareth, Amen. And that's it. You are saved! Jesus will reveal Himself to you, and your life will undergo a significant transformation. Your marriage, health (especially addiction), finances, and all areas of your life will experience an extraordinary change. And never look back. In Jesus Almighty name. Amen.